Weekly Power Outlet US - Week 43

Find out why prices are surging, the latest on reliability standards for renewables, and the turbulent journey of wind power. Plus, mega oil mergers hint at a shift in energy focus!

Nat Gas Rally, FERC/NERC, Energy Wall Street

Energy Market Update Week 43, brought to you by Acumen.

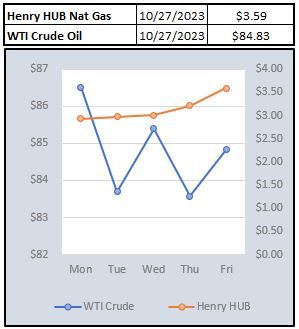

For More Updates Like This, Subscribe Here!Last week we started the Weekly talking about the round-trip natural gas had made over a two-week period. This week natural gas is back on the roller coaster heading higher. The November contract came off the board, so December is now the front month trading near $3.60 this Friday morning which is a roughly 10% move from midweek lows.

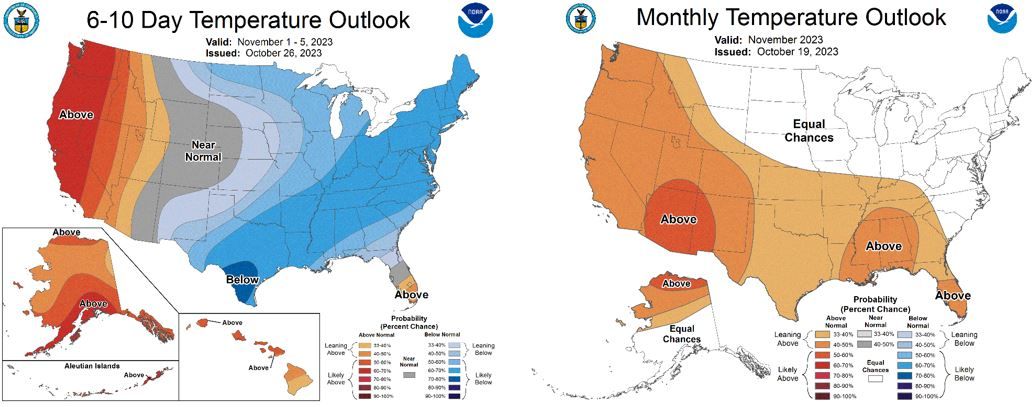

Thursday the EIA reported storage numbers that showed an injection of just 74 Bcf compared to estimates of 81 Bcf for the week ending October 20th. This shortfall, along with the first blast of winter, are the main drivers pushing the markets higher. Winter storms, and associated cold temps, raced across the northern mountains into the northern plains this week. As shown on the map below, those temps are expected to push into the southeast displacing some unseasonably balmy weather.

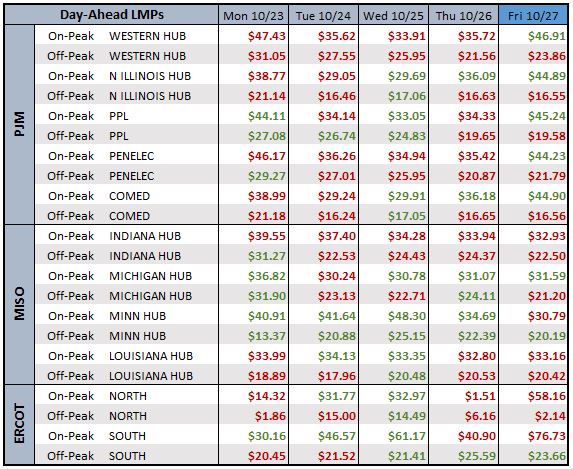

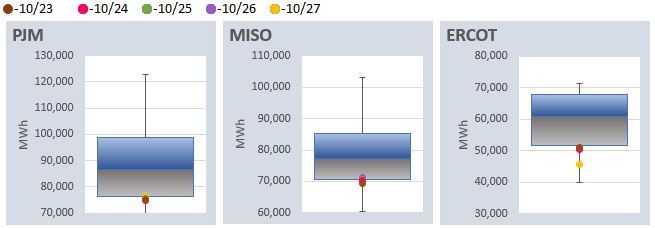

The rally in natural gas didn't show up in the day ahead market just yet, but if natural gas can hold gains and weather driven demand rises, expect higher prices next week. It's worth pointing out, ERCOT North On Peak, almost averaged a negative LMP on Thursday. This is a far cry from last week where we highlighted a few hours that pushed the average to around $100/MW.

This week FERC released their October 2023 Highlights. One of the highlighted releases was a directive to NERC to develop reliability standards for renewable assets. Basically, FERC is giving NERC a mandate that includes timelines over the next three years to write the standards.

All of the commissioners have been in agreement that the way the transition is playing out has been somewhat concerning, and none more than Commissioner James Danly. A quote by Commissioner Danly that appeared in a Utility Dive article on the subject leaves little ambiguity. “The reliability risks at issue arise from the rapid, widespread (one might say reckless) addition of IBRs,” Danly said, noting the issue has been discussed since 2016 and any new standards won’t take effect until the end of the decade. “Up to nearly fourteen years to establish mandatory and enforceable NERC reliability standards to address a known, and potentially catastrophic, risk to the reliability of the [bulk power system] is simply too long a time to wait.”

Wind power has had a rough go of it this year. Yesterday saw another shoe drop as Siemens Energy shares were down almost 40% in trading after announcing their quarterly earnings. The price is now the lowest since it was spun off from parent company, Siemens, in 2020. The culprit was its wind business, Siemens Gamesa, where quality control issues and rising cost of capital delayed projects have become an issue. The company lowered outlook and advised shareholders it was talking to the German government about guarantees backing long term projects. This has led some pundits to call it a bailout which might make securing those guarantees harder.

In other corporate news, this week saw the second mega merger of oil companies in the past two weeks. Chevron is paying $53 billion for Hess following up the roughly $60 billion Exxon is paying for Pioneer last week. While two isn't a trend, given the size it's safe to say there is some rethinking amongst managements. These deals are a 180 from the shareholder request to return cash or invest in renewables. These two deals are could certainly be viewed that large investment in fossil fuel is not dead.

NOAA WEATHER FORECAST

DAY-AHEAD LMP PRICING & SELECT FUTURES

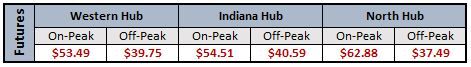

RTO AROUND THE CLOCK CALENDAR STRIP

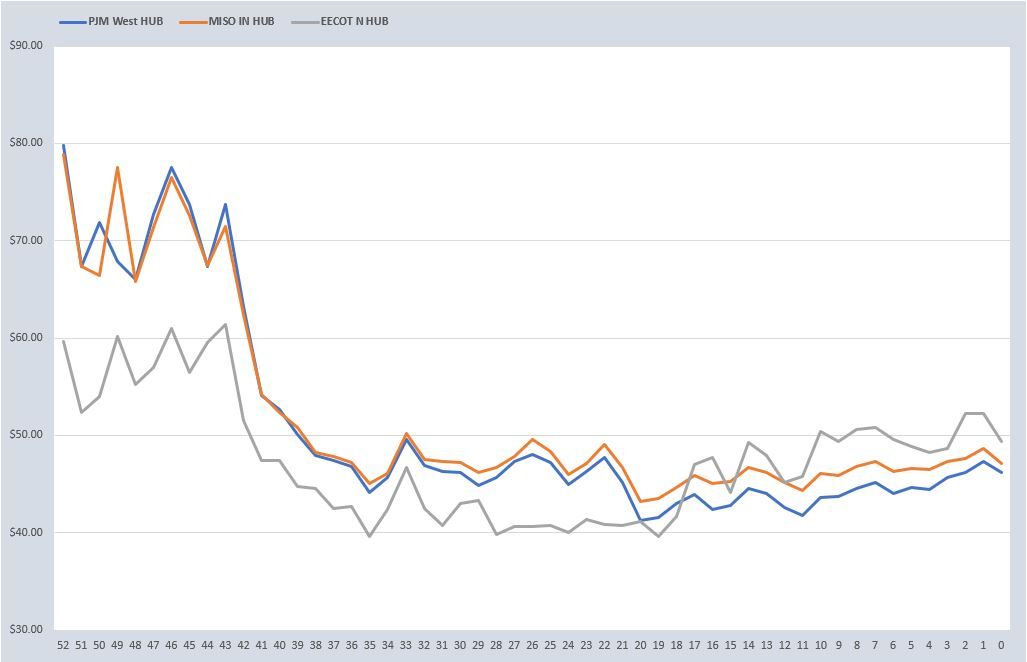

DAILY RTO LOAD PROFILES

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: