Weekly Power Outlet US - Week 10

PJM Market Monitor 2022, EIA Outlook, and US Bank Stocks.

Energy Market Update Week 10, brought to you by Acumen.

For More Updates Like This, Subscribe Here!On Thursday, the PJM Market Monitor released their 2022 State of the Market Report. For those new to this annual report, it is a very thorough report of the state on the PJM market and worth a glance. We are going to consider ourselves in good company as the introductory statements dive right into subjects we covered in an earlier blog, Electric Market Trend 2023 And Beyond - natural gas deliverability and the intermittent nature of renewables.

"Regardless of derating values, solar resources will not be available when the sun is not shining and wind resources will not be available when the wind is not blowing. But, given current constraints on the gas pipeline system, the potential sources of the more than two BCF/day are not clear. It is essential that the Commission, PJM, PJM stakeholders and the gas industry (transportation, storage and commodity) address the issues of gas availability."

- PJM Market Monitor

The report also points out that eventually FERC and ISOs are going to need to recognize the "inconsistencies" between the business models of pipelines and power producers.

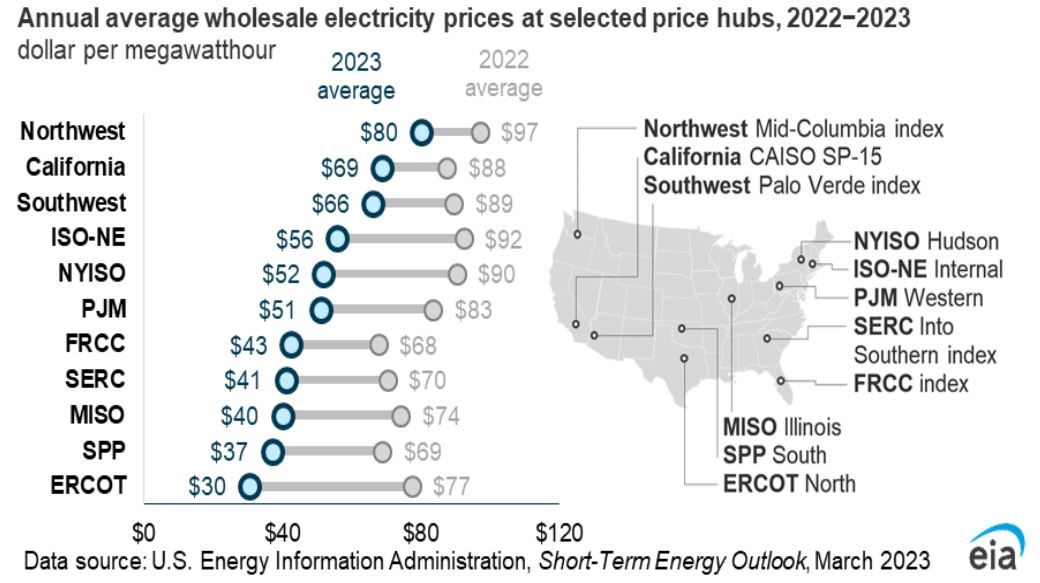

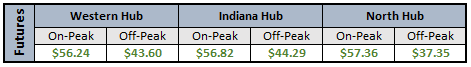

In a week of reports, EIA released their much-anticipated March outlook earlier in the week. Like the PJM report, this too, was loaded with interesting data. One thing we wanted to point out was the forecasted pricing for electricity across the US by regions and ISO.

The image above shows forecasted prices coming down substantially in some cases year over year. As would be expected, higher production of natural gas with lower prices are cited.

We try to stick to energy markets on these pages, specifically electricity. That said, every so often something outside the markets, yet related to them, catches our eye. As we write this on Friday morning, the FDIC has basically seized Silvergate Bank and by the end of the day, Silicon Valley Bank might be on that list. If interested, there are plenty of articles to search for to get an explanation on each case. Our interest lies in credit markets in general. Any time we see these types of events, it usually plays out something like risk departments being asked to work the weekend to make sure counterparties are identified, followed by some analysis which leads to some "reigning in" or increased credit standards. Bottom line, credit may tighten, and credit is the lifeblood of the energy complex. Stay tuned.

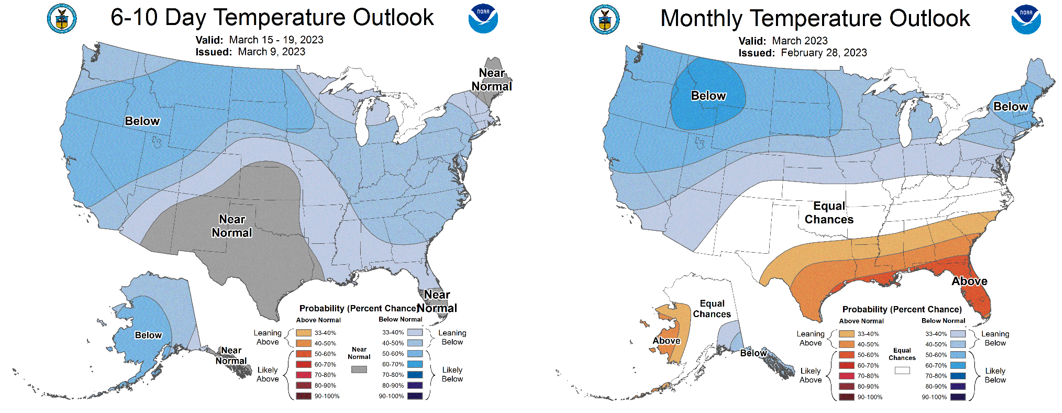

NOAA WEATHER FORECAST

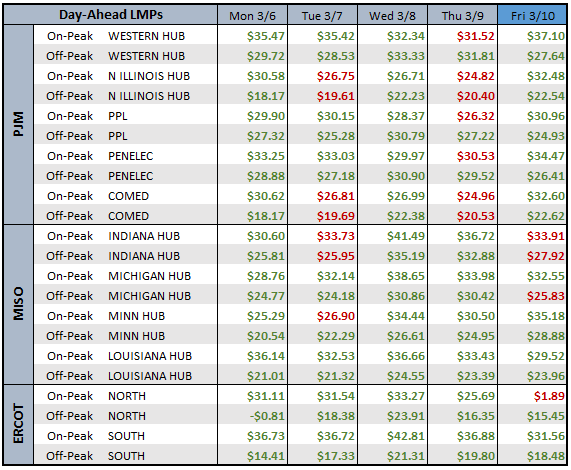

DAY-AHEAD LMP PRICING & SELECT FUTURES

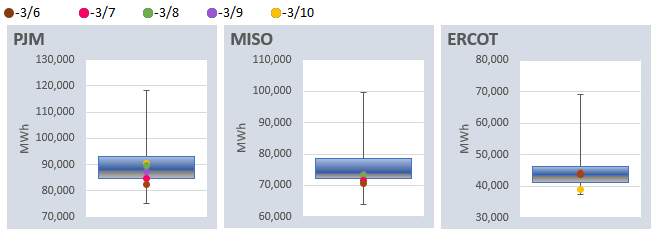

DAILY RTO LOAD PROFILES

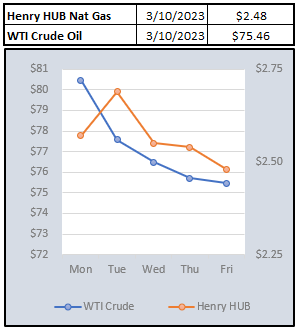

COMMODITIES PRICING

Not getting these updates delivered weekly into your inbox? Let's fix that, click the link below: